'What Works on Wall Street' and the Trade of 2023

Merry Christmas and Happy Holidays!

As you may know, investing can be a confusing and intimidating endeavor, with a wide range of strategies and techniques to choose from. That's why I was really interested in the book "What Works on Wall Street" by James O'Shaughnessy. In it, he conducts a study in which he analyzed the performance of various investment strategies and techniques over a period of over 50 years, from 1950 to 2009.

O'Shaughnessy looked at a wide range of factors, including value, size, price momentum, and earnings growth, in order to determine which strategies and techniques had consistently outperformed the market over this time period.

Some of the key findings I found interesting from the study include the following:

Value investing, which involves buying stocks that are undervalued relative to their intrinsic value, has consistently outperformed the market.

Stocks with a high dividend yield have also tended to outperform the market.

Stocks with a high price-to-earnings (P/E) ratio have generally underperformed the market.

Small-cap stocks have outperformed large-cap stocks over the long term.

Overall, the study concludes that certain investment strategies and techniques have a strong track record of outperforming the market, while other approaches tend to be less successful. It's important to note that these results are based on historical data and past performance is not necessarily indicative of future results.

So, what can we take away from this study? It's important to approach investing with a long-term perspective and to consider a variety of factors when choosing an investment strategy. Value investing, dividend investing, and investing in small-cap stocks are all approaches that have tended to outperform the market over the long term, but it's still important to do your own research and due diligence before making any investment decisions. Remember that no investment strategy is guaranteed to be successful and it's always important to diversify your portfolio and manage risk appropriately.

Performance in 2022

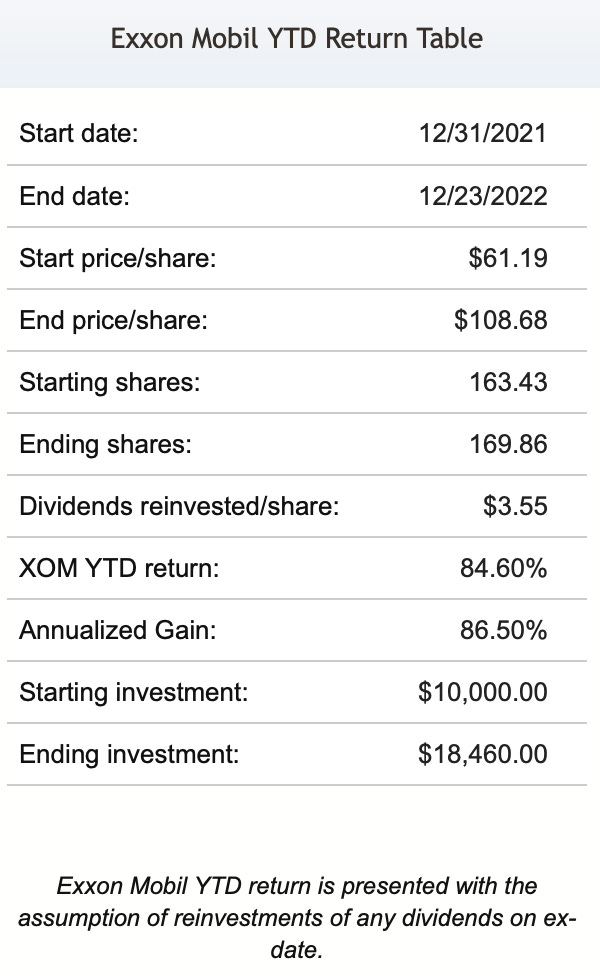

In 2022, our "Trade of the Year" was buying Exxon Mobil through the purchase of stock or options (such as $90 Calls). This resulted in a return of 85% for the year. Prior to 2022, the energy industry had been underinvested in for the past decade. Many investors preferred to chase the growth of tech stocks and other inflated industries, rather than allocate capital for new projects into energy. As a result, old machinery and processes were in need of modernization. In addition, global conflict with Russia, which controls around 40% of the global oil supply, has driven up both the price and demand for oil. While these factors have contributed to the performance of the energy industry, they are part of a larger macroeconomic backdrop that is beyond the scope of this discussion.

Is this the end of "abundance" in the stock market?

The current economic situation is causing some challenges on knowing exactly how things will play out in the long term. Here are some additional key points to consider:

Inflation is when the cost of goods and services goes up. It can be influenced by various factors such as the supply and demand of goods, the cost of raw materials, and the amount of money in circulation.

Both the value of stocks (equities) and the cost of borrowing money (through treasuries, which are a type of government bond) are down. This can make it harder for companies to grow and raise money.

In the long term, it's possible that we may need to be prepared for difficult measures in order to create stability and opportunities for growth. For example, in the 1980s, the Federal Reserve allowed interest rates to go up in order to combat high inflation. This policy led to two recessions, but it helped bring down inflation in the long run.

The yield curve, which shows the relationship between the interest rates on different types of bonds, is inverted. This means that shorter-term bonds have higher interest rates than longer-term bonds, and this has historically been a sign of a recession.

Companies may have a harder time accessing debt, and those that can't secure debt beyond seven or eight years may have to pay higher rates to borrow money.

Rising interest rates could have a negative impact on corporate earnings and liquidity. This means that companies may have to pay more to refinance their existing debt, which could limit their ability to make strategic decisions and put pressure on the value of stocks and other growth investments.

The real growth rate and its impact on inflation-adjusted earnings is another factor to consider. If the real growth rate is slow, it could affect the value of a company's earnings when adjusted for inflation.

Trade of 2023

As avid investors, we are always on the lookout for opportunities to grow our portfolio and maximize returns. And this year is no different, as we seek to identify a trade that has the potential to deliver significant returns. It's difficult to predict exactly how the current economic situation will play out, and leaders in all industries will need to be prepared for a prolonged downturn that could be indeterminate in its timing, impact, and duration. As a result, it may be wise for you to personally adopt a "wait-and-see" approach and be prepared for a range of potential outcomes given your appetite for risk.

Alternatively, I have thoroughly researched and analyzed trades entering the new year, and am confident in this upcoming year’s potential for success. I will be sharing all the details of my trade of the year, including the rationale behind my decision and how you can get in on the action.

Whether you are a seasoned investor or new to the game, I hope this will provide valuable insights and inspiration for your own investment strategies. So let's dive in and explore this exciting opportunity together!