On The Rock

Top Themes of the Week

In the US market, stock futures are rallying with a sense of relief as bond yields continue to rise and the spread between short-term and long-term interest rates widens.

The hopes of economic stimulus in China have pushed stocks higher in Hong Kong and mainland China, potentially leading to increased buying in American Depositary Receipts and emerging market stocks. Premier Li reaffirms that China's 5% GDP growth target remains on track, while Treasury Secretary Janet Yellen plans to visit China in early July, fueling optimism.

Base metals, excluding gold, silver, and copper, are on the rise, supported by a slightly weaker US dollar. Today's 5-year bond auction is anticipated to be well-received, and the International Monetary Fund's Gopinath suggests that central banks may need to tolerate higher inflation to avoid financial crises.

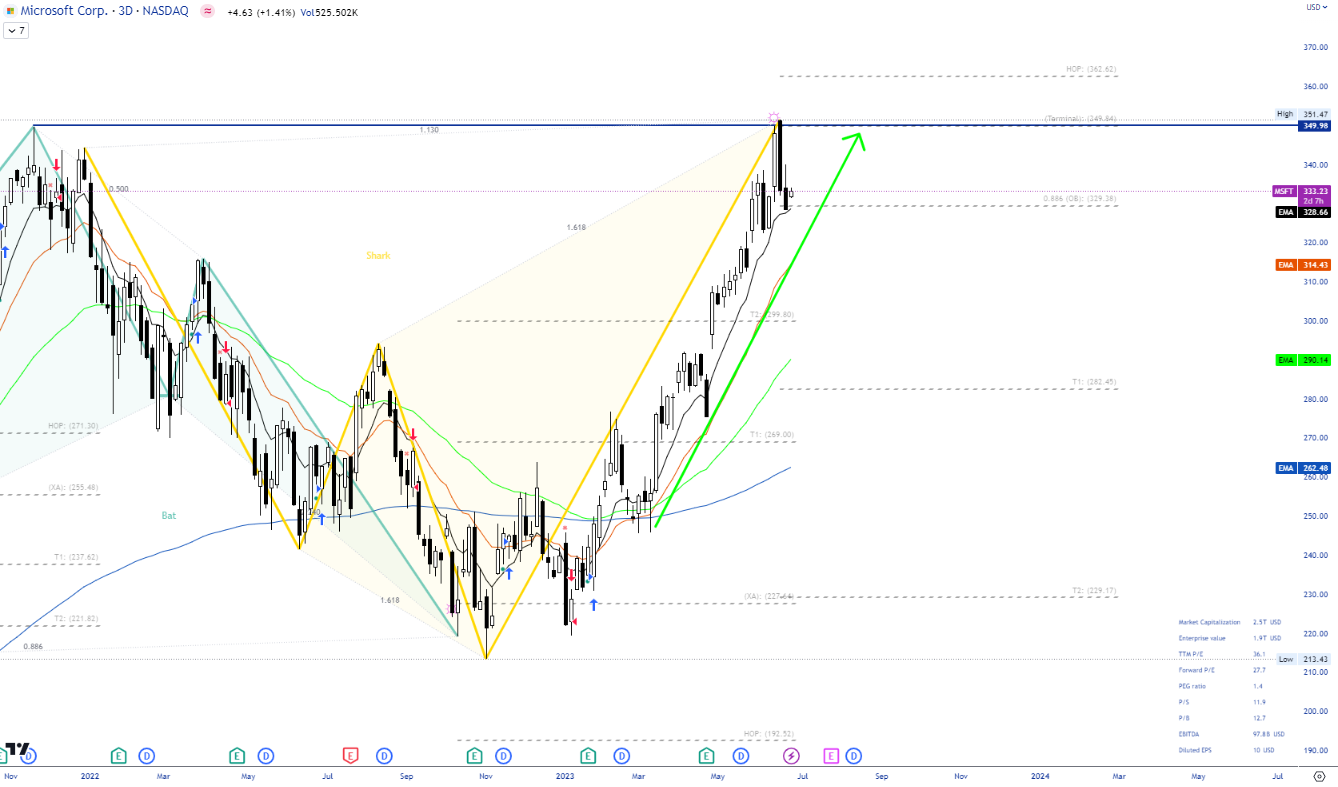

Microsoft Aims for $500B Revenue

In a court filing, Microsoft's MSFT 0.00%↑ CEO Satya Nadella shared that the company has set its sights on achieving "at least 10%" annual revenue growth until 2030, with a goal of reaching $500 billion. This growth-oriented strategy aligns with Microsoft's enduring mission and culture. While there is no consensus on this target, analysts estimate this announcement provides reassurance to investors and stakeholders.

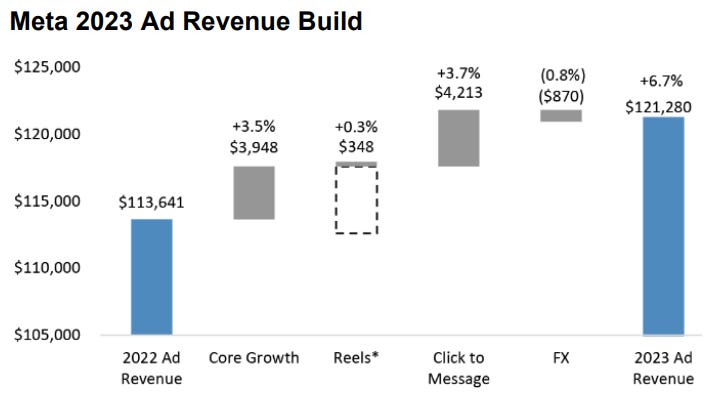

Meta's WhatsApp Milestone

Meta META 0.00%↑ has introduced new features for its WhatsApp Business app. These features include the ability to create ads within the app, linking to Facebook or Instagram, without the need for a business account on either platform. Additionally, Meta has launched a paid message feature.

While WhatsApp currently offers a free tier allowing 1,000 service conversation messages per month, it does not include marketing, utility, and authentication conversations.

This update coincides with Meta's announcement that it has surpassed 200 million registered businesses on the platform, marking a fourfold increase since mid-2020. Bloomberg reports that the WhatsApp ads business is operating at a $1.5 billion run rate, showing an 80% year-over-year growth.

The Click to Message opportunity could generate a revenue run rate exceeding $20 billion by the end of 2024. Notably, there has been a noticeable surge in US WhatsApp commercials, indicating the company's focus on leveraging this platform for business purposes.

Google Shifts Focus from Smart Glasses to AR Software

According to Business Insider, Google has made the decision to discontinue its "Iris" smart glasses and instead concentrate on developing a software platform to attract headset manufacturers like Samsung.

Recognizing Apple's dominance in hardware (evident in the Pixel vs. iPhone example), Google's aim to become the Android of augmented reality seems like a logical strategic move.

Nvidia and Snowflake Expand Strategic Partnership

Snowflake SNOW 0.00%↑ and Nvidia NVDA 0.00%↑ have officially announced an expanded partnership at the Snowflake Summit in Las Vegas. The CEOs of both companies revealed that they will collaborate to offer businesses of all sizes an accelerated path to creating customized generative AI applications using their proprietary data, all securely within the Snowflake Data Cloud.

This collaboration follows Snowflake's recently announced partnership with Microsoft, which involves product integrations with Azure OpenAI, Azure ML, and other initiatives. The participation of Nvidia's CEO in the summit keynote makes this announcement anticipated but nonetheless significant.