On The Rock

Top Themes of the Week

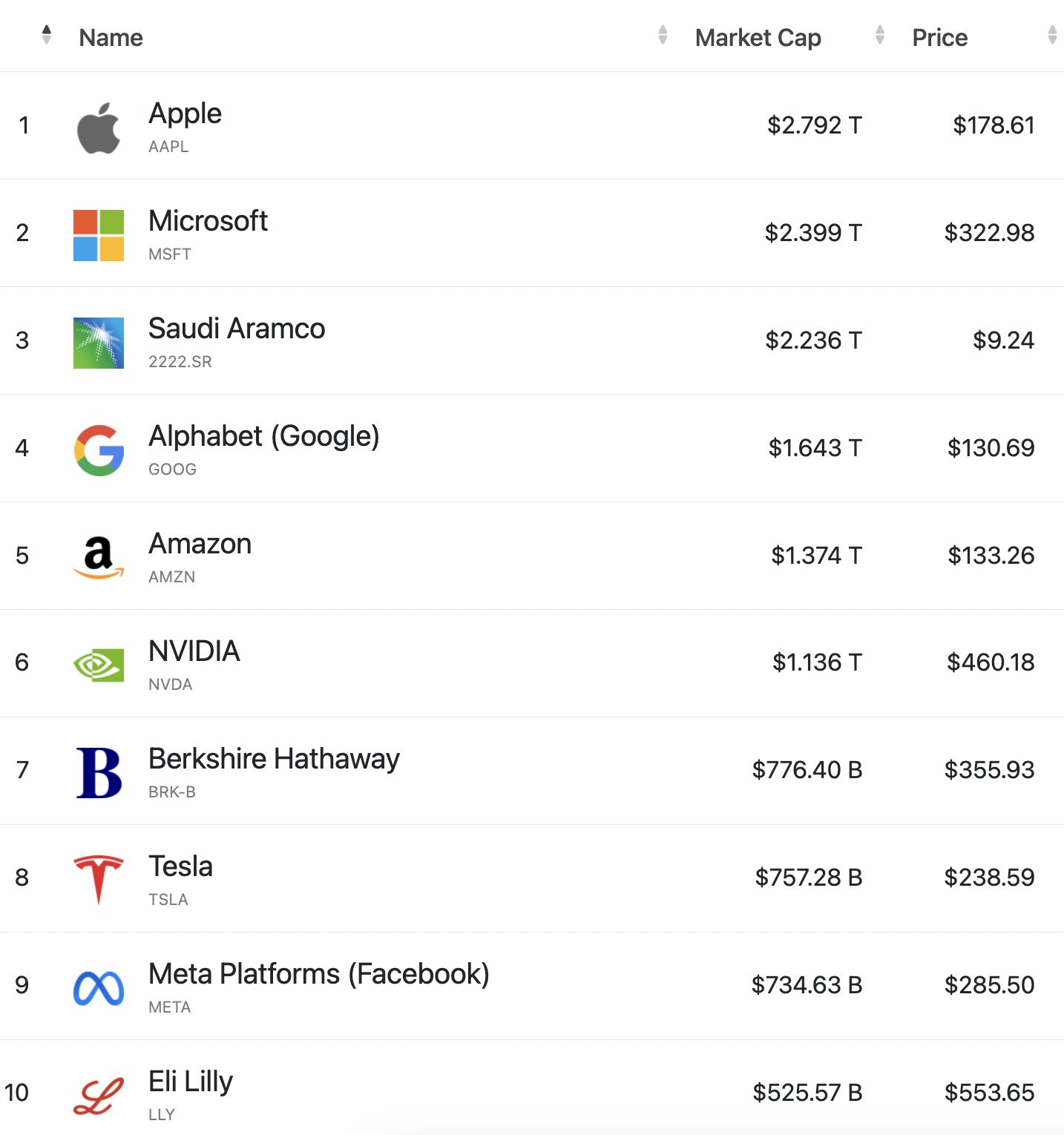

The collective value of the world's ten largest stocks has risen to $14.37 trillion, marking an increase from last week's $14.12 trillion.

The subset of tech stocks, known as the S&P 7, has surged 54% in value throughout this year. Merely three weeks ago, the S&P 7 experienced an increase of 70%. In contrast, the remaining S&P 493 stocks have seen a modest rise of only 4%. These very stocks have been responsible for 75% of the entire Nasdaq's gains in the current year. Despite recent market fluctuations, tech stocks continue to play a pivotal role in upholding the overall market. Investors continue to exhibit strong confidence in AI.

Top 5 Tech

Microsoft - MSFT 0.00%↑

Infusing AI into Windows Apps: Microsoft's Trailblazing Efforts: Microsoft is venturing into uncharted territory by integrating AI capabilities into native Windows 11 applications. The company's experimental foray involves apps like Photos, Snipping Tool, and Paint, potentially revolutionizing user experiences. This cutting-edge evolution, however, demands specialized hardware such as Neural Processing Units or Vision Processing Units to fully unlock the potential of AI-infused features. The strategic fusion of software and hardware could usher in an era of enhanced efficiency and user-friendly AI interactions within the Windows ecosystem.

Microsoft's Adaptive Shift in Activision Blizzard Deal: In a tactical pivot, Microsoft is reconfiguring its collaboration with Activision Blizzard, specifically concerning cloud gaming rights. This move aims to address concerns raised by UK regulators about the potential impact of Microsoft's proposed $68.7 billion deal on the competitive landscape of cloud gaming. By transferring these rights to Ubisoft, a key player in the gaming industry, Microsoft demonstrates its commitment to ensuring fair competition. Nonetheless, this adjustment has triggered a new regulatory investigation in the UK, highlighting the meticulous scrutiny that major tech agreements undergo to maintain a balanced market.

Amazon - AMZN 0.00%↑

Advancing Diabetes Care Access: Amazon is introducing a groundbreaking initiative by offering automatic coupons for over 15 insulin and diabetes care brands through Amazon Pharmacy. This initiative is set to benefit customers by significantly reducing costs for essential products like insulin vials, pens, continuous glucose monitors, and pumps. Notable manufacturers like Novo Nordisk, Eli Lilly LLY 0.00%↑, and Sanofi are part of this effort, with the coupons targeting commonly prescribed items. Eligible customers can enjoy cost reductions, starting from a base level of $35 per month, potentially easing the financial burden associated with diabetes care.

Expanding Fire TV Entertainment Landscape: Amazon has unveiled the new Fire TV Channels app, enhancing the entertainment options for Fire TV customers. This app provides access to an impressive array of over 400 free, ad-supported TV channels, including well-known names such as ABC News, CBS Sports, Fox Sports, MLB, and Martha Stewart. In conjunction with this launch, Amazon has also brought new content providers on board, such as Variety, Rolling Stone, The Hollywood Reporter, Billboard, GameSpot, Looper, and Funny or Die. This expansion is available to users of Fire TV-branded smart TVs and streaming devices.

In addition, Amazon is in preliminary discussions with Disney regarding collaboration on the streaming version of ESPN currently in development. Amazon's potential involvement could involve offering the service through its streaming platforms, thereby expanding its reach. The streaming service's proposed price range of $20 to $35 per month could position it as one of the higher-priced streaming options in the US. Meanwhile, Nielsen's integration of first-party audience performance data from streaming platforms for live events holds significance, particularly for Amazon, which previously reported viewership figures notably higher than Nielsen's assessments for its NFL Thursday Night Football package. This development underscores the evolving landscape of entertainment consumption and measurement.

Apple - AAPL 0.00%↑

Empowering Podcast Creators: Apple has revealed a series of exciting enhancements to its podcast creator toolkit, aimed at fostering a more robust podcasting ecosystem. One of the standout additions is Subscription Analytics, now available within Apple Podcasts Connect. This dashboard serves as a hub for podcasters to meticulously monitor how their audience engages with their content. This addition is set to provide creators with valuable insights into their subscribers' behavior, thereby enhancing their ability to fine-tune their podcasting strategies.

Moreover, Apple is expanding its Delegated Delivery offering, a feature that permits creators to seamlessly publish their episodes from alternative hosting providers. This move promotes a more flexible and diverse podcasting landscape. Additionally, Apple is streamlining access to podcast analytics by integrating them into the Linkfire marketing platform.

Google - GOOG 0.00%↑

Collaborative Efforts in AI-Driven Music: YouTube's Artistic Partnership: YouTube, in collaboration with Universal Music Group, has embarked on a groundbreaking initiative to reshape the landscape of music royalties in the era of artificial intelligence. A diverse selection of Universal artists, including Frank Sinatra’s estate, Rosanne Cash, Max Richter, and Yo Gotti, are joining forces to navigate the complex intersection of AI-generated content and artistic compensation. This collaboration aims to pave the way for a more equitable future for musicians and creators in an environment increasingly influenced by generative AI tools. As AI technology facilitates unparalleled levels of user interaction and manipulation of artistic content, this partnership seeks to proactively address the challenges that arose during the advent of streaming and similar services..

Expanding Entertainment Choices: Google TV's Enriched Channel Lineup: Google TV is enhancing its entertainment offering by introducing an additional 25 free channels to its repertoire. The notable feature is that these channels can be enjoyed without the need for extra app installations or sign-ins. With this update, the built-in collection now boasts more than 100 free channels, out of a total of 800 available channels. The newly introduced channels cover a diverse range of content, spanning TV shows like "Top Gear" and "Baywatch," along with game shows, music channels, multicultural entertainment, and more, enriching viewers' options for leisure.

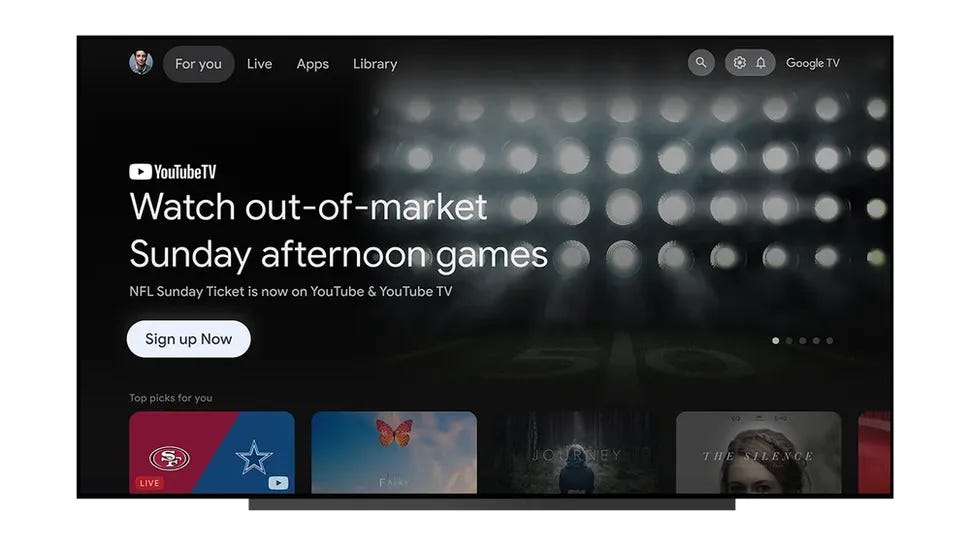

Seamless Integration of NFL Sunday Ticket on Google TV: In an exciting development for football enthusiasts, NFL Sunday Ticket on YouTube and YouTube TV will be seamlessly integrated into Google TV during the upcoming football season. This integration promises users access to live Sunday afternoon games that are out-of-market, as well as highlights and recommendations for the top games of the week. This comprehensive offering will be available directly on the Google TV home screen. For YouTube TV subscribers with NFL Sunday Ticket as part of their membership, the content will conveniently populate the channel guide on the Live tab, ensuring swift access to their desired games.

Meta - META 0.00%↑

Expanding Threads' Reach: Meta's Web Version: Meta, the tech giant behind the innovative Threads feature, is preparing to unveil a web version of its platform, a significant step that echoes competition with its counterparts, most notably X. While users have already enjoyed the ability to view select Threads posts on the web, this access has been restricted, as Threads has predominantly catered to mobile devices. Adam Mosseri, Instagram's head, took to his Instagram profile to reveal that the web iteration of Threads is on the brink of release, currently undergoing internal testing within Meta.

This strategic move represents Meta's endeavor to broaden the accessibility and impact of Threads, aligning with the evolving patterns of digital engagement. The introduction of a web version positions Meta to cater to a wider audience and diversify user experiences beyond the mobile realm.

Sports & Media Updates

Shifting NFL Viewing: A recent survey conducted by the National Research Group has illuminated a significant shift in NFL viewership preferences. Impressively, 71% of NFL fans expressed their willingness to consider subscribing to a new streaming service for out-of-market NFL games. Considering the vast viewership of over 143 million Americans aged 13 and above who watched NFL games on TV or in person in 2021, an estimated 6 million individuals could potentially be open to investing around $350 per season for NFL Sunday Ticket. This long-standing live sports package, historically controlled by DirecTV, offers access to out-of-market games not covered by local broadcasts, cablecasts, or streaming services within individual DMA regions.

Premium: Disney's Future Plans for ESPN