On The Rock: Top Themes of the Week

Last week, everyone was busy discussing what's going to happen with the debt ceiling - and this talk is set to continue into this upcoming week. Along with some important measurements of the overall economy, such as the Consumer Price Index for April that showed a slowing down of inflation, we saw the tech-focused Nasdaq go up a bit by 0.4%. This was partly due to some big moves by companies like Google GOOGL 0.00%↑, which saw an 11% increase, thanks to its annual event for software developers.

On the other hand, the Dow Jones, a group of 30 large companies, felt some downward pressure, dropping by 1.1%.

It was another busy week for company earnings reports, with lots of updates across industries such as media, gaming, music, digital entertainment, and more.

Disney's Magical Quest for Streaming Profits

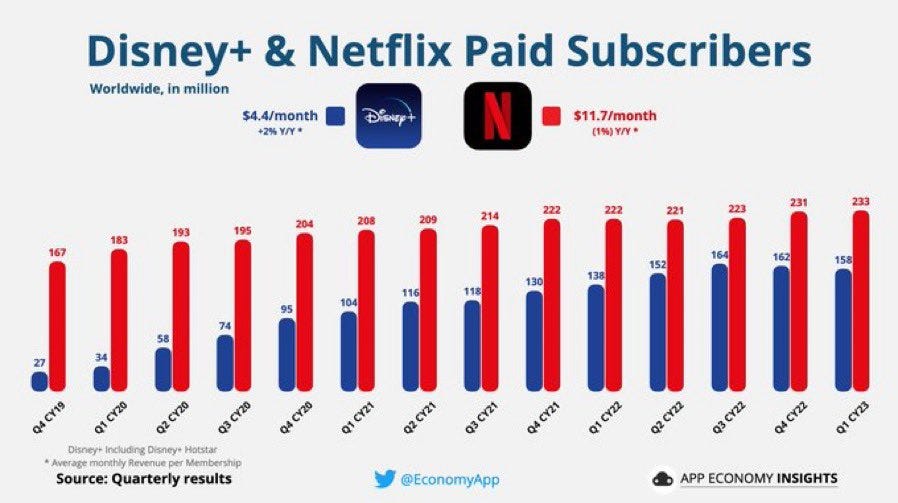

Last week, Disney's DIS 0.00%↑ focus on turning their streaming business profitable was clear from their earnings report. Despite losing about 4 million Disney+ subscribers, profits from streaming improved by $400 million compared to the last quarter. When will they buy Netflix NFLX 0.00%↑ for its subs and trendy content?

Disney also plans to launch a combined Hulu and Disney+ app in the US by the end of this year, aiming to boost user engagement and decrease cancellations. They are also pushing for more subscribers to the ad-supported Disney+ tier and intend to increase the price for the ad-free tier to widen the price gap.

Disney also plans to adjust their content volume and investment in international streaming to increase profits. Savings in marketing are expected as well.

Even with the spotlight on streaming, Disney's Parks & Experiences business outperformed expectations, especially the international parks. However, they anticipate increased costs in the second half of the fiscal year and lower profits due to comparison with the 50th-anniversary celebration at Walt Disney World.

Despite these challenges, they are determined to make their streaming services profitable and see the move of ESPN, their sports network, to a direct-to-consumer model as inevitable.

EA Games: Shaping the Social Future of Gaming and Banking on Blockbusters

EA EA 0.00%↑ shared a vision of video games as future social networks in their latest earnings call. They plan to increase player engagement by introducing more social elements within their games.

In the current economic climate, hesitancy around spending has benefitted EA's top franchises like The Sims, FIFA, and Madden. Despite a drop in total bookings, Q4 results exceeded expectations with strong performances from FIFA, Apex Legends, and The Sims 4.

Looking forward, EA is optimistic about their upcoming Lord of the Rings Mobile game and the recently launched STAR WARS Jedi: Survivor. The gaming industry, EA believes, is at a turning point with a growing, diversifying audience.

Warner Music's New Tune: A Tech-Focused Future and Industry Overhaul

Warner Music Group's WMG 0.00%↑ new CEO Robert Kyncl announced major changes during their latest earnings call, pointing to a flawed agreement model between labels and digital service providers. He believes this leads to undervalued music streaming compared to video streaming.

Kyncl plans to invest more in technology for increased efficiency and enhanced fan engagement. Despite a Q2 cash-flow loss, WMG surpassed revenue and operating income expectations. Music Publishing outperformed, while Recorded Music suffered due to an ad slowdown and a quieter release schedule.

Management anticipates a stronger second half of the fiscal year, driven by an improved music slate, a revived ad market, and growth in emerging markets.

Premium: Trade of the Week

Looking to take your investments to the next level and earn some serious gains this month? Then you don't want to miss out on what our Premium Membership has to offer. Despite an overall bearish sentiment approaching the markets in the coming months, there are still opportunities to be had if you know where to look.

Upgrade to a Premium Membership and unlock these exclusive features:

MARINA™ AI forecasting for popular stocks and indexes (S&P 500, Nasdaq, Apple, Google, Microsoft, Amazon, Meta, etc.)

Personal Wealth Management practices used by Institutional Investors and High-Net-Worth Individuals

Monthly dividend strategies and trade setups via “Passive Returns”

Performance Dashboards for various sectors such as Tech, Media, Telco, Sports, AI, Crypto, and more.

Direct access to the CrimsonRock team during typical market hours (i.e., Monday - Friday from 9:30am-4:00pm ET)

Full access to the CrimsonRock newsletter archive

With a Premium Membership, you'll have everything you need to make informed decisions and achieve major returns. And don't worry if you're currently a free member, upgrading is easy and affordable. Plus, you'll have access to all the tools and insights you need to build your portfolio and grow your wealth.

Don't wait any longer, upgrade today and start taking your investing to the next level!