Passive Returns: May 2023

Looking to take your investments to the next level and earn some serious gains this month? Then you don't want to miss out on what our Premium Membership has to offer. Despite an overall bearish sentiment approaching the markets in the coming months, there are still opportunities to be had if you know where to look.

Upgrade to a Premium Membership and unlock these exclusive features:

MARINA™ AI forecasting for popular stocks and indexes (S&P 500, Nasdaq, Apple, Google, Microsoft, Amazon, Meta, etc.)

Personal Wealth Management practices used by Institutional Investors and High-Net-Worth Individuals

Monthly dividend strategies and trade setups via “Passive Returns”

Performance Dashboards for various sectors such as Tech, Media, Telco, Sports, AI, Crypto, and more.

Direct access to the CrimsonRock team during typical market hours (i.e., Monday - Friday from 9:30am-4:00pm ET)

Full access to the CrimsonRock newsletter archive

With a Premium Membership, you'll have everything you need to make informed decisions and achieve major returns. And don't worry if you're currently a free member, upgrading is easy and affordable. Plus, you'll have access to all the tools and insights you need to build your portfolio and grow your wealth.

Don't wait any longer, upgrade today and start taking your investing to the next level!

Equities (Stocks)

The S&P 500 Index is facing resistance in the 4100s and is responding to a pattern-based sell signal that triggered last week. I believe that a slide can be seen as it trades through the 4010-4040 pattern breakout zone and momentum could build. The lower-end of the one-sigma forecast cone could slide towards 3800 over the next two to three weeks. The index may even break medium-term support near 3760 and extend to retest the 3491 Oct 2022 low before setting a low for the bear cycle. The recent rejection of the upper end of the index’s residual range reinforces the outlook.

The Philadelphia Semiconductor Index, after rejecting expected medium-term resistance near 3200, has dropped to test key pattern support at 2850-2900. I believe that the index may fall to medium-term support near 2500 before bottoming out in the late spring or summer.

The EURO STOXX 50 Index has shown signs of trend deceleration near the 4415 Nov 2021 cycle peak, and experts are looking for a medium-term bearish trend reversal, a view that would gain traction with a sustained break below the 4324 Mar high. A break below 4202-4262 would confirm the trend change in their view and set the market on a course for an initial drop to medium-term support surrounding 4000.

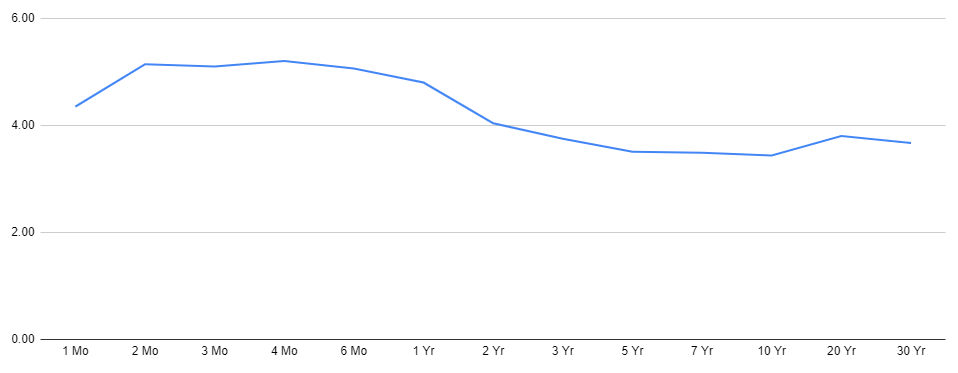

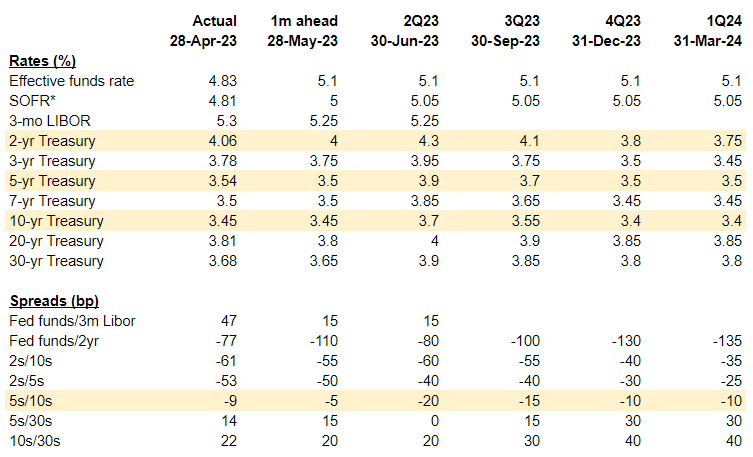

Fixed Income (Bonds or Debt Securities)

The 2-year note is in a positive trend after a strong rally earlier this year. It's currently consolidating around the 4.26-4.335% support level, which I expect to hold. If it drops to 4.50%, that will be another level of support. The tactical resistance level to watch is 3.87%.

The 5-year note is also in a good position for a bullish breakout, as long as it doesn't dip below 3.75-3.80% support. If it continues to stay above that level, I could see a rise above the 3.235-3.305% resistance level.

The 5s/10s curve (yield spread between the 5-year and 10-year US Treasury bonds) is consolidating after a strong upward trend earlier this year. I think that trend will continue, with initial targets of 9bp and then 18bp. The key short-term support level to watch is -14bp/-17bp.

The 10-year TIPS breakevens have tightened after hitting resistance in the 230s. This includes several technical levels, such as the 50-day, 100-day, and 200-day moving averages, and the March Fibonacci retracement levels. I think they will test the 209bp support level soon, andexpect risky markets to correct in the coming weeks, which could cause breakevens to drop below 200bp.

Trade Setups

Whether you're a seasoned trader or just starting out, see below for potential opportunities that could help you achieve your financial goals this year and beyond.