On The Rock: Top Themes of the Week

Last week was marked by a flurry of updates from various industries, including Entertainment, Streaming, Sports Betting, E-Commerce, Advertising, and more. While there were some notable stock movements, it was a bit of a mixed week for the market, with the major indices closing slightly up or down. The S&P 500 index closed down by 0.3%, while the Nasdaq index closed up by 0.6%.

One factor that contributed to the fluctuations in the market was the release of the January PPI report, which turned out to be hotter than expected. This, coupled with concerns about a possible 50 basis point rate hike in March, added to the choppiness in trading this week.

Despite the mixed performance, there were several new developments. For example, the streaming industry saw significant updates with the launch of new shows and the addition of new features. Additionally, the sports betting industry continued to gain momentum, with more states legalizing sports betting and more companies entering the market.

Shift in Paramount

In 2022, Paramount Global PARA 0.00%↑ experienced a significant decrease in free cash flow due to heavy investment in streaming, resulting in a loss of $500 million. Despite this, Paramount+ added 9.9 million new subscribers and PlutoTV added 6.5 million new monthly active users in 2022.

In 2023, Paramount Global will focus on integrating Paramount+ with Showtime to achieve future cost savings of up to $700 million annually. The company plans to increase revenue growth in streaming by raising prices for its premium P+ tier and its Essentials tier. The company is also still optimistic about international streaming opportunities and plans to leverage existing relationships and assets to accelerate growth in this market.

In terms of advertising revenue, the company expects to see some stabilization and growth in H2 2023, with national advertising improving in Q1. The company is also optimistic about its film division, Paramount Pictures, as it has a strong slate for 2023 and 2024 following a successful 2022 with six #1 movies at the US box office on an eight-picture slate.

Airbnb Poised to Take Off

Airbnb ABNB 0.00%↑ has been doing well in Q4 and Q1 despite weather-related issues. They have reduced their headcount but increased their revenue by 75% compared to 2019. Guest demand has been strong, and the company has seen a rebound in active listings. The company's Q1 revenue guidance was above expectations, and they plan to invest in new products and services to expand beyond their core. Wall Street analysts are not too concerned about the downward pressure on average daily rates, as Airbnb plans to use "new and improved" pricing and discounting tools to drive greater affordability and value for guests.

Is Retail Investing at the Right Time?

Last year was challenging for retail investors who experienced a relentless series of gut punches that knocked the air out of basement-dwelling day traders and crushed some of the most popular retail names, which led to a near-record year-end liquidation.

In contrast, institutional investors remained broadly bearish on stocks. However, in January 2023, retail investors poured an average of $1.51bn/day into the US markets, the highest amount ever recorded.

Experts expects retail flows into cash equities to decrease in the weeks ahead due to seasonality, although retail investors still have plenty of capital to allocate to riskier investments, as seen from the all-time high net assets of retail money market funds. The above doesn’t mean that retail investors are running out of capital to allocate to risky investments, and the potential for bullish positions to be added in the options market.

Crypto’s Path to Regulation

The SEC (Securities and Exchange Commission) has recently been taking steps to regulate the crypto industry. They voted on new regulations that would expand custody rules to include cryptocurrencies and require custodians, such as exchanges, to have federal or state registrations to hold customer assets. Companies would need to ensure proper segregation of assets to be considered a "qualified custodian" under the new rules. However, it's important to note that the proposed changes did not address which cryptocurrencies would be classified as securities. Other recent activities include the following:

The SEC settled a case with Kraken, a crypto exchange, which barred the exchange from offering its staking program. This move has been criticized by some in the crypto industry as overreaching.

The SEC charged Terraform Labs, the company behind Terra Luna, with a multi-billion dollar fraud related to "crypto asset securities fraud." These recent moves by the SEC, including the Terra lawsuit, are attempts to assert jurisdictional authority over the industry.

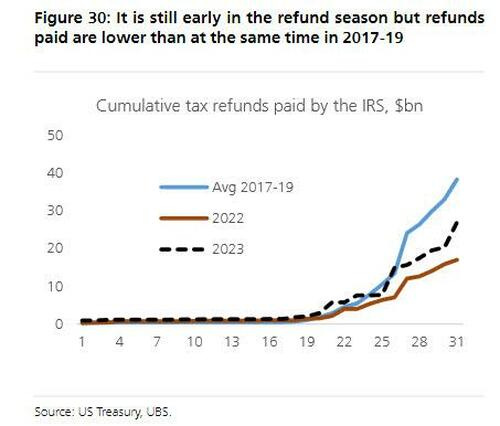

Slow Start to the Tax Season

In 2022, people in the US received larger tax refunds than in previous years, which helped to boost spending. However, this year, tax refunds are expected to be lower because a special tax credit that was in place last year has expired. Tax refunds are payments that the government gives back to people who overpaid their taxes during the year. Typically, about half of the tax refunds are paid in February and March, and they amount to about $200 billion, or 6% of disposable income during those months. Although refunds have been slower to come in this year compared to previous years, there were some processing delays in 2022 which eventually resulted in higher refunds. This year, there are still some delays, but they are not as bad as last year. Overall, tax refunds are expected to be about 10% lower than last year, and it is unlikely that we will see such high refunds again this year.

Marina: Earnings Update

An early look at two of the most popular stocks that report earnings this week, including one which is featured in the CrimsonRock “Trade of the Year” :